(1) | This column represents the aggregate grant date fair value of shares granted to our directors in 2017. For a discussion of Mr. Roth's senior management agreement and employee compensation for 2023, please see the section of this Proxy Statement titled Certain Relationships and Related Transactions. For a discussion of Mr. Hussey's senior management agreement and employee compensation for 2023, please see the section of this Proxy Statement titled Executive Compensation.

| | | | | | | | | | | | | | | | Name | Fees Earned or Paid in Cash ($)(6) | Stock Awards ($)(1) | Total

($) | | Joy T. Brown(2) | 102,000 | 170,024 | 272,024 | | H. Eugene Lockhart(3) | 119,750 | 170,024 | 289,774 | | Peter K. Markell(4) | 107,750 | 170,024 | 277,774 | | John McCartney(3)(5) | 247,500 | 170,024 | 417,524 | | Hugh E. Sawyer(3) | 113,500 | 170,024 | 283,524 | | Ekta Singh-Bushell(3) | 116,000 | 170,024 | 286,024 | | Debra Zumwalt(3) | 111,000 | 170,024 | 281,024 | |

(1)This column represents the aggregate grant date fair value of shares granted to our directors in 2023. Grant date fair value is based on the closing price of Huron stock on the day of grant. Each of these grants vests ratably over the 12 calendar quarters following the grant. (2)On December 31, 2023, Ms. Brown held 4,209 unvested restricted stock units. (3)On December 31, 2023, each of Mr. Lockhart, Mr. McCartney, Mr. Sawyer, Ms. Singh-Bushell, and Ms. Zumwalt held 500 shares of unvested restricted stock and 3,358 unvested restricted stock units. (4)On December 31, 2023, Mr. Markell held 5,146 unvested restricted stock units. (5)Mr. McCartney has access to office space at the Company’s principal business offices in Chicago. The Company does not incur any incremental costs in connection with the provision of this office space. (6)Includes cash board fees deferred by non-employee directors under our Deferred Compensation Plan, as further described under the heading "Deferred Compensation Plan" within the Compensation Discussion and Analysis of this Proxy Statement. During 2023, Ms. Zumwalt was the only non-employee director to make deferrals of her cash board fees in the Deferred Compensation Plan. Ms. Zumwalt and Mr. McCartney have account balances in the Deferred Compensation Plan. The earnings on Ms. Zumwalt's and Mr. McCartney’s account balances in the Deferred Compensation Plan were $154,737.68 and $196,485.36, respectively, in 2023.

EXECUTIVE OFFICERS The Company’s executive officers are as follows: | | | | | | | | | | Name | Age | Position | | C. Mark Hussey | 63 | Chief Executive Officer and President | | J. Ronald Dail | 54 | Executive Vice President and Chief Operating Officer | | John D. Kelly | 48 | Executive Vice President, Chief Financial Officer and Treasurer | Ernest W. Torain, Jr.1 | 59 | Executive Vice President, General Counsel and Corporate Secretary |

(1)On March 11, 2024, Huron announced that Mr. Torain was leaving the Company, effective March 15, 2024. Additional information is provided below under the caption “Executive Leadership Transitions.” C. Mark Hussey’s biographical information is provided above under the caption “Directors Standing for Election.”

| | | | | | J. Ronald Dail Chief Operating Officer | Mr. Dail was appointed as Huron’s chief operating officer on July 1, 2022 succeeding C. Mark Hussey. Mr. Dail has over 30 years of management consulting experience and has worked with many of Huron's largest clients. Prior to the COO role, Mr. Dail was a member of the executive leadership team for Huron’s healthcare business and the national leader of Huron’s performance improvement business unit. Mr. Dail has led numerous large-scale transformation efforts working with a variety of clients, including children’s hospitals, large academic health centers and multihospital systems. He is an expert in health management operations, specializing in managing the design and delivery of strategic information systems and operational reengineering projects. Through his leadership, Huron’s performance improvement business unit has delivered meaningful and sustainable results to clients throughout the country, enabling them to achieve hundreds of millions of dollars in annual, recurring benefits. Prior to joining Huron, Mr. Dail joined Stockamp & Associates in 2004, which was acquired by Huron in 2008. Prior to joining Stockamp, he had a successful 12-year career with Accenture (formerly Andersen Consulting LLP), where he specialized in complex program management, strategic planning, systems integration and process improvement initiatives. Mr. Dail holds a Bachelor of Arts in economics from the University of North Carolina at Chapel Hill. | | | John D. Kelly Executive Vice President, Chief Financial Officer and Treasurer | John D. Kelly was appointed executive vice president and chief financial officer of Huron stock on the dayeffective January 3, 2017. He has served as Huron’s treasurer since February 2016. He had served as chief accounting officer of grant. EachHuron from February 2015 until January 2017, and had served as corporate vice president from November 2012 until his appointment as executive vice president. Previously, Mr. Kelly had served as controller of these grants vests ratably over the 12 calendar quarters following the grant. |

(2) | The amount in this column represents investment gainsHuron from November 2012 until February 2015, and prior to that served as assistant controller from October 2009. Mr. Kelly served as Huron's assistant treasurer from February 2015 until February 2016. Prior to joining Huron's Finance and Accounting department, Mr. Kelly was a director in the deferred compensation plan. Huron does not offerCompany's Disputes and Investigations practice for three years, serving clients in the manufacturing and services industries. Before he joined the Company in December 2006, Mr. Kelly held several positions within Deloitte & Touche’s Assurance and Advisory Services group, most recently as a pension plan. The amount shown above represents that portionsenior manager. He received both a B.S. and M.S. in Accounting from the University of Notre Dame. Mr. Kelly is a Certified Public Accountant (Illinois) (inactive). Commencing in February 2020, Mr. Kelly was appointed as a member of the account earnings for 2017 that exceededboard of directors of Shorelight Holdings LLC.

|

| | | | | | | | Ernest W. Torain, Jr. Executive Vice President, General Counsel and Corporate Secretary | Ernest W. Torain, Jr. was appointed executive vice president, general counsel and corporate secretary effective March 1, 2020. Before joining Huron, from September 2010 to February 2020, Mr. Torain was in-house counsel at Illinois Tool Works Inc. (ITW), a public manufacturer of industrial equipment, in a variety of roles, most recently serving as associate general counsel. At ITW, Mr. Torain counseled business executives in a variety of areas, including mergers and acquisitions, litigation, intellectual property and general commercial matters. Prior to joining ITW, he spent more than six years at Vedder Price P.C., from 2004 to 2010, where he was a shareholder in the SEC benchmark “market” rate equalfirm’s securities and capital markets practice. Prior to 120%Vedder Price, Mr. Torain spent more than seven years at Katten Muchin Rosenman LLP from 1998 to 2004 including as a partner from 2001 to 2004 in the firm’s securities and M&A practices. He received his J.D. from the University of the long-term applicable federal rate (based on the average rate for 2017Michigan Law School and received his A.B. in economics from Dartmouth College. He is a member of 2.72%). For 2017, the actual earnings forThe Executive Leadership Council and The Economic Club of Chicago. Commencing in April 2022, Mr. McCartney and Ms. Zumwalt were $134,348 and $28,141, respectively. |

(3) | At December 31, 2017, each of Messrs. Edwards, Lockhart, Massaro, McCartney, Moody and Ms. Zumwalt held 5,158 shares of restricted common stock.

|

(4) | Mr. McCartney has access to office space at the Company’s principal business offices in Chicago. The Company does not incur any incremental costs in connection with the provision of this office space.

|

(5) | Hugh E. SawyerTorain was appointedelected to the board in February 2018. He hadof directors of the Chicago Botanic Garden. Mr. Torain previously served as a managing director at Huron from January 2010 until May 2017, where he ledmember of the Operational Improvement Service Line for Huron’s Business Advisory practice. All compensation paid to Mr. Sawyer in 2017, which consistedboard of base salary paid through his departure and paymentdirectors of his 2016 bonus, was in connection with his managing director role.

Chicago Humanities Festival. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

EXECUTIVE LEADERSHIP TRANSITIONS As previously announced, Mr. Hussey, the president, assumed the role of Chief Executive Officer on January 1, 2023 following the retirement of Mr. Roth from the CEO role after a distinguished 20-year career with Huron, including having served 13 years as Chief Executive Officer. Mr. Hussey was also appointed as a director when he assumed the CEO role. Mr. Roth was then appointed as Vice Chairman, Client Services, and continues to serve on the board of directors. Additionally, on March 11, 2024, Huron announced that Mr. Torain was leaving the Company, effective March 15, 2024, and Hope Katz, Corporate Vice President, Legal Affairs and Corporate Secretary would assume the majority of Mr. Torain's responsibilities. Ms. Katz joined Huron in 2018 and served as Deputy General Counsel prior to her new role. DELINQUENT SECTION 16(a) REPORTS Pursuant to Section 16(a) of the 1934 Act, the Company’s directors, executive officers and persons who beneficially own 10% or more of our common stock (the “Section 16 Reporting Persons”) are required to report their initial ownership of common stock and subsequent changes in that ownership to the SEC. Section 16 Reporting Persons are required to furnish the Company with copies of all Section 16(a) forms that they file. Based upon our review of forms filed by the Section 16 Reporting Persons pursuant to the 1934 Act, we have not identified anyone late filingsfiling in 2017.STOCK OWNERSHIP2023 by James H. Roth, the Company's Vice Chair, Client Services.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS CERTAIN BENEFICIAL OWNERS AND MANAGEMENT MANAGEMENT The following table sets forth, as of the Record Date, certain information regarding the beneficial ownership of our common stock by: • each person known by us to beneficially own 5% or more of our common stock; • each of our named executive officers; • each member of our board of directors; and • all directors and executive officers as a group. Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC”)SEC and generally means that a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security and includes options that are currently exercisable or exercisable within 60 days.days as of the record date. Each director, officer or 5% or more stockholder, as the case may be, has furnished us with information with respect to beneficial ownership. Except as otherwise indicated, beneficial owners of common stock listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply. | | | | | | | | | | | | Beneficial Ownership | | | Name of beneficial owner (1) | | Shares | | | % | | Beneficial owners of 5% or more: | | | | | | | | | Wellington Management Group LLP (2) | | | 3,102,878 | | | | 14.02 | | Van Berkom & Associates Inc. (3) | | | 1,927,915 | | | | 8.71 | | The Vanguard Group, Inc. (4) | | | 1,774,571 | | | | 8.01 | | BlackRock, Inc. (5) | | | 1,444,220 | | | | 6.50 | | Dimensional Fund Advisors LP (6) | | | 1,393,051 | | | | 6.30 | | Boston Partners (7) | | | 1,286,433 | | | | 5.81 | | FMR LLC (8) | | | 1,173,291 | | | | 5.30 | | Directors and Executive Officers: | | | | | | | | | James D. Edwards (9) | | | 21,524 | | | | * | | C. Mark Hussey (10) | | | 98,945 | | | | * | | John D. Kelly (11) | | | 9,386 | | | | | | H. Eugene Lockhart (12) | | | 22,160 | | | | * | | George E. Massaro (13) | | | 17,744 | | | | * | | John McCartney (14) | | | 57,155 | | | | * | | John S. Moody (15) | | | 19,653 | | | | * | | Diane E. Ratekin (16) | | | 39,957 | | | | * | | James H. Roth (17) | | | 380,291 | | | | 1.69 | | Hugh E. Sawyer (18) | | | 13,095 | | | | * | | Debra Zumwalt (19) | | | 12,283 | | | | * | | All directors and executive officers as a group (11 persons) (20) | | | 692,193 | | | | 3.08 | |

* | Indicates less than 1% ownership.

|

(1) | The principal address for each of the stockholders, other than Wellington Management Group LLP, Van Berkom & Associates Inc., The Vanguard Group, Inc., BlackRock, Inc., Dimensional Fund Advisors LP, Boston Partners, and FMR LLC, listed below, is c/o Huron Consulting Group Inc., 550 West Van Buren Street, Chicago, Illinois 60607.

|

(2) | The principal address of Wellington Management Group LLP is 280 Congress Street, Boston, Massachusetts 02210. The shares are owned by Wellington Management Group LLP and the following subsidiaries of Wellington Management Group LLP: Wellington Group Holdings LLP, Wellington Investment Advisors Holdings LLP and Wellington Management Company LLP. Information regarding beneficial ownership of our common stock by Wellington Management Group LLP is included herein in reliance on a Schedule 13G/A filed with the SEC on February 8, 2018.

|

(3) | The principal address of Van Berkom & Associates Inc. is 1130 Sherbrooke Street West, Suite 1005, Montreal, Quebec H3A 2MB. Information regarding beneficial ownership of our common stock by Van Berkom & Associates Inc. is included herein in reliance on a Schedule 13G filed with the SEC on February 13, 2018.

|

(4) | The principal address of The Vanguard Group, Inc. is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. The shares are owned by The Vanguard Group, Inc. and the following subsidiaries of The Vanguard

|

| Group, Inc.: Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd. Information regarding beneficial ownership of our common stock by The Vanguard Group, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on February 9, 2018.

|

(5) | The principal address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. The shares are owned by the following subsidiaries of BlackRock, Inc.: BlackRock (Netherlands) B.V., BlackRock Advisors (UK) Limited, BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Ltd. and BlackRock Investment Management, LLC. Information regarding beneficial ownership of our common stock by BlackRock, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on January 25, 2018.

|

(6) | The principal address of Dimensional Fund Advisors LP is Building One, 6300 Bee Cave Road, Austin, Texas 78746. Information regarding beneficial ownership of our common stock by Dimensional Fund Advisors LP is included herein in reliance on a Schedule 13G/A filed with the SEC on February 9, 2018.

|

(7) | The principal address of Boston Partners is One Beacon Street, 30th Floor, Boston, Massachusetts 02108. Information regarding beneficial ownership of our common stock by Boston Partners is included herein in reliance on a Schedule 13G filed with the SEC on February 13, 2018.

|

(8) | The principal address of FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. The shares are owned by FMR LLC and the following subsidiaries of FMR LLC: FIAM LLC, Fidelity (Canada) Asset Management ULC, Fidelity Institutional Asset Management Trust Company, FMR Co., Inc., and Strategic Advisers, Inc. Information regarding beneficial ownership of our common stock by FMR LLC is included herein in reliance on a Schedule 13G/A filed with the SEC on February 14, 2018.

|

(9) | Includes 4,355 shares of restricted common stock.

|

(10) | Includes 15,647 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 56,459 shares of restricted common stock.

|

(11) | Includes 7,109 shares of restricted common stock.

|

(12) | Includes 4,355 shares of restricted common stock.

|

(13) | Includes 4,355 shares of restricted common stock.

|

(14) | Includes 4,355 shares of restricted common stock, as well as 1,259 shares held by a wholly-owned limited liability company of which Mr. McCartney is the sole owner.

|

(15) | Includes 4,355 shares of restricted common stock.

|

(16) | Includes 7,904 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 8,775 shares of restricted common stock.

|

(17) | Includes 160,746 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 50,533 shares of restricted common stock, as well as 3,855 shares held by a family limited liability company.

|

(18) | Includes 8,799 shares of restricted common stock.

|

(19) | Includes 4,355 shares of restricted common stock.

|

(20) | Includes an aggregate of 184,297 shares issuable upon exercise of options held by members of the group that are exercisable currently or within 60 days of the Record Date, as well as 157,805 shares of restricted common stock held by the Directors and Executive Officers listed above.

|

| | | | | | | | | | | | | Beneficial Ownership | | Name of beneficial owner (1) | Shares | % | | | Beneficial owners of 5% or more: | | | The Vanguard Group, Inc. (2) | 2,047,974 | 10.9 | | BlackRock, Inc. (3) | 1,682,094 | 9.0 | | Dimensional Fund Advisors LP (4) | 1,271,045 | 6.8 | | | Directors and Executive Officers: | | | | Joy T. Brown(5) | 3,275 | * | | J. Ronald Dail (6) | 26,498 | * | | C. Mark Hussey (7) | 102,967 | * | | John D. Kelly (8) | 46,636 | * | | H. Eugene Lockhart (9) | 28,624 | * | | Peter K. Markell (10) | 6,060 | * | | John McCartney (11) | 55,705 | * | | James H. Roth (12) | 79,093 | * | | Hugh E. Sawyer (13) | 22,360 | * | | Ekta Singh-Bushell (14) | 10,544 | * | | Ernest W. Torain, Jr. (15) | 11,666 | * | | Debra Zumwalt (16) | 22,489 | * | | All directors and executive officers as a group (12 persons) (17) | 415,917 | 2.2 | |

* Indicates less than 1% ownership. (1)The principal address for each of the stockholders, other than The Vanguard Group, Inc., BlackRock, Inc. and Dimensional Fund Advisors LP listed below is c/o Huron Consulting Group Inc., 550 West Van Buren Street, Chicago, Illinois 60607. (2)The principal address of The Vanguard Group, Inc. is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. The shares are owned by The Vanguard Group, Inc. Information regarding beneficial ownership of our common stock by The Vanguard Group, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on February 13, 2024. (3)The principal address of BlackRock, Inc. is 50 Hudson Yards, New York, New York 10001. The shares are owned by the following subsidiaries of BlackRock, Inc.: Aperio Group, LLC, BlackRock Advisors, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited, BlackRock Fund Advisors, and BlackRock Fund Managers Ltd. Information regarding beneficial ownership of our common stock by BlackRock, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on January 25, 2024. (4)The principal address of Dimensional Fund Advisors LP is 6300 Bee Cave Road, Building One, Austin, Texas 78746. Information regarding beneficial ownership of our common stock by Dimensional Fund Advisors LP is included herein in reliance on a Schedule 13G/A filed with the SEC on February 9, 2024. (5)Includes 544 unvested restricted stock units that will vest within 60 days of the Record Date and excludes 3,124 additional unvested restricted stock units. (6)Includes 2,452 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date and 827 unvested shares of restricted stock and excludes 10,588 additional unvested restricted stock units. (7)Excludes 18,761 unvested restricted stock units. (8)Excludes 8,305 unvested restricted stock units. (9)Includes 250 unvested shares of restricted stock and 443 unvested restricted stock units which will vest within 60 days of the Record Date and excludes 2,473 additional unvested restricted stock units. (10)Includes 801 unvested restricted stock units that will vest within 60 days of the Record Date and excludes 3,546 additional unvested restricted stock units. (11)Includes 250 unvested shares of restricted stock and 443 unvested restricted stock units which will vest within 60 days of the Record Date as well as 1,259 shares held by a wholly-owned limited liability company of which Mr. McCartney is the sole owner and excludes 2,473 additional unvested restricted stock units. (12)Includes 3,855 shares held by a family limited liability company and excludes 8,001 unvested restricted stock units. (13)Includes 250 unvested shares of restricted stock and 443 unvested restricted stock units which will vest within 60 days of the Record Date and excludes 2,473 additional unvested restricted stock units. (14)Includes 250 unvested shares of restricted stock and 443 unvested restricted stock units which will vest within 60 days of the Record Date and excludes 2,473 additional unvested restricted stock units.

(15)Excludes 4,034 unvested restricted stock units. (16)Includes 250 unvested shares of restricted stock and 443 unvested restricted stock units which will vest within 60 days of the Record Date and excludes 2,473 additional unvested restricted stock units. (17)Includes 1,225 shares issuable upon exercise of options held by one member of the group that are exercisable currently or within 60 days of the Record Date; an aggregate of 3,560 restricted stock units that will vest and are issuable within 60 days of the Record Date; an aggregate of 2,077 unvested restricted stock; and excludes an aggregate of 64,283 unvested restricted stock units held by the Directors and Executive Officers listed above. CORPORATE SOCIAL RESPONSIBILITY We continue to invest in the growth and development of our people, initiate programs to advance social responsibility, uphold strong governance practices, and actively work to minimize our environmental footprint. Our dedication to sustainability is evident in our alignment with key global standards. We prioritize the United Nations Sustainable Development Goals (SDGs) and particularly five goals that resonate with our values-driven culture and the work we do for our clients each day: good health and well-being, quality education, gender equality, decent work and economic growth, and climate action. Below are the highlights of how we have advanced those SDGs in 2023. Investing In and Supporting Our People We recognize that the success of our organization depends on the professional advancement and fulfillment of our people. We place personal and professional growth at the heart of our mission. Our highly skilled workforce is evident through the more than 2,000 technology certifications held by our employees. Along with technical skills, we encourage the growth and development of our employees through a dynamic learning ecosystem that includes in-person and virtual trainings, coaching and mentoring, microlearning, social learning and self-directed learning. In 2023, our employees participated in over 360 live courses and completed over 23,900 hours of LinkedIn Learning courses. In addition, to adjust to the changing workplace, we have proactively adapted our talent development initiatives, which include training, certification, and performance management to accommodate the unique needs of our employees in a hybrid work environment. Through our leadership development experiences, self-directed learning, virtual workshops, and cohort-based learning options, we have enhanced our approach to identifying our future leadership talent within the firm, including a greater focus on how we continue to champion development pathways for our diverse communities. We have continued to utilize personal development assessments such as our 360-degree feedback tool for our most senior levels of leadership to provide meaningful feedback and further enhance ongoing employee growth and development. Advancing Our Commitment to Diversity, Equity and Inclusion As our global footprint continues to expand, we are committed to expanding our diverse representation across our organization. We continue to see positive growth in our diverse representation since implementing our five-year diversity and inclusion action plan in September 2020. Our dedicated efforts to cultivate female leaders have played a pivotal role in shaping a robust pipeline of leadership talent. On a global basis, women make up almost half of our employee population representing 47.6% of our workforce. In North America women represent more than half of our employee population at 52.3%. Globally, women represent 31.2% of our leadership (principals, managing directors, corporate vice presidents, and executives) and 31.9% of our leaders in North America. At the end of 2023, racial and ethnic minorities made up approximately 28.4% of our U.S. employee population, an increase from our 2019 benchmark of 22%. At the leadership level, racial and ethnic minority representation increased to 11.6% from our benchmark of 6% in 2019. Our employee resource groups and networks provide supportive spaces for our colleagues to cultivate growth and development, learn from one another, celebrate their unique identities, and make a positive impact both within and outside of the workplace. Along with our nine employee resource groups (iMatter Teams), Huron supports five networks including Experienced Hires, Helping Hands, Public Health, Rising Professionals, and Sustainability. These networks collectively strive to empower our workforce through professional development, social engagement, and community impact. By providing platforms for mentorship, networking events, and skill development, these networks help ensure that employees at all career stages find opportunities for growth and connection. In 2023 for the thirteenth consecutive year, Consulting Magazine named Huron a ‘Best Firm to Work For,’ recognizing our strong commitment to our people, our values, our clients and the communities we serve. We are also proud to highlight recognition by the Human Rights Campaign Foundation as a Best Place to Work for LGBTQ Equality in 2023-2024, Consulting Magazine for Promoting and Advancing Diversity, Equity, Inclusion, and Belonging and Crain's for acknowledging our CEO and President, Mark Hussey, as a Chicago Notable Leader in Diversity, Equity and Inclusion. Making an Impact in the Global Communities We Serve Our commitment to giving back to the communities in which we live and work remains steadfast. We have consistently sought to strengthen our alliances with local organizations that share our dedication to community well-being. Through many community

service and volunteering opportunities, we collaborate with non-profit organizations, working together to reduce disparities and enhance access to vital resources within our communities. Our efforts extend to a diverse range of causes, including support for local food banks, relief agencies, programs aimed at empowering at-risk youth, and educational institutions. In 2023, we participated in various service events to promote good health and well-being with organizations such as the Movember Foundation, St. Jude Children’s Research Hospital, the American Cancer Society ResearcHERS campaign and the Adyar Cancer Hospital in Chennai, India. As part of our recognition of Childhood Cancer Awareness Month, Huron leaders visited and toured the pediatric and research wards at the Adyar Cancer Hospital in Chennai, India and made a donation to support the hospital’s impactful work. In 2023, for our annual Day of Service event more than 2,200 Huron employees partnered with organizations around the globe to participate in 129 community service events in more than 80 different locations. Together we prepared and served more than 4,200 warm meals to people experiencing homelessness and to families of hospitalized children, wrote more than 500 letters and cards for hospitalized children, women who are homeless, and LGBTQ+ seniors, sorted and packed 108,000 lbs. of food equating to more than 90,000 meals for those in need, weeded, landscaped, cleaned and maintained 27 different parks, gardens, beaches and farms, sorted, inventoried and restored more than 48,000 donated goods to be distributed to local communities, supported more than 200 animals by assisting at local animal shelters, cleaned, painted and rehabbed 26 homes, schools, shelters and community buildings, and tutored, coached and mentored more than 1,200 youth. Taking Action for a Sustainable Future Our environmental sustainability strategy is focused on the areas where we have an opportunity to make an impact aligned to our potential business risks. As a professional services firm, we do not engage in manufacturing, product distribution, or hazardous waste generation and our offices have low water consumption. We have continued to measure our greenhouse gas emissions (GHG) emissions and, in 2023, we neutralized our 2022 Scope 1 and Scope 2 GHG emissions through our collaboration with the non-profit organization Climate Vault. Climate Vault removes carbon pollution permits from regulated carbon markets, which effectively decreases CO2 emissions in a quantifiable and verifiable way, while also supporting carbon dioxide removal technologies. Managing Responsibly We uphold ethics and integrity in everything we do. Our Code of Business Conduct and Ethics (the “Code”) serves as a crucial framework for guiding our workforce, helping our people understand expectations and standards governing individual and business conduct and supporting sound decision-making. Our commitment to ethical business practices is foundational to our standing as a premier consulting firm. We hold our employees to the highest ethical standards, not only requiring compliance with applicable laws, rules, and regulations but extending to ethical leadership and cultivating a work environment characterized by integrity, transparency, responsibility, and trust. In addition, Huron prohibits the use of Company funds, assets, services, or facilities on behalf of a political party or candidate and the Company does not reimburse employees for any personal contributions made to a political party or candidate. To learn more about our environmental, social and governance efforts, please visit our website at: https://ir.huronconsultinggroup.com to read our 2023 Corporate Social Responsibility Report (CSR). The CSR also provides more quantitative and qualitative measurements in the Sustainability Accounting Standards Board (SASB) addendum and in the Equal Employment Opportunity (EEO-1) report. The report mentioned above, or any other information from the Huron website, are not part of, or incorporated by reference into this Proxy Statement. STOCKHOLDER COMMUNICATIONS POLICY The Company’s board of directors has established a process for stockholders to send communications to the board of directors. Stockholders may communicate with any member of the board of directors, including the chairperson of any committee, an entire committee or the independent directors or all directors as a group, by sending written communications to: Corporate Secretary Huron Consulting Group Inc. 550 West Van Buren Street 17th Floor Chicago, Illinois 60607 E-mail messages should be sent to corporatesecretary@hcg.com. A stockholder must include his or her name and address in any such written or e-mail communication. The communication must indicate that the sender is a Company stockholder. Each communication intended for the board of directors and received by the Corporate Secretary that is related to the operation of the Company and is not otherwise commercial in nature will be forwarded to the specified party following its clearance through

normal security procedures. If the communication is mailed as personal, it will not be opened, but rather will be forwarded unopened to the intended recipient.

EXECUTIVE COMPENSATION COMPENSATION DISCUSSION

COMPENSATION DISCUSSION AND ANALYSIS ANALYSIS The Compensation Discussion and Analysis provides information regarding the objectives and elements of our compensation program with respect to the compensation of persons who appear in the Summary Compensation Table (who we refer to collectively throughout this Proxy Statement as our “named"named executive officers”officers" or “NEOs”"NEOs"). | | | SECTION 1 — EXECUTIVE SUMMARY

| Huron is a global professional services firm committed to achieving sustainable results in partnership with its clients. The company brings depth of expertise in strategy, technology, operations, advisory services and analytics to drive lasting and measurable results in the healthcare, higher education, life sciences and commercial sectors. Through focus, passion and collaboration, Huron provides guidance to support organizations as they contend with the change transforming their industries and businesses.

Named Executive Officers

During 2017, Huron’s named executive officer team consisted of the following individuals:

• Mr. Roth, Chief Executive Officer, President and Director.

• Mr. Hussey, Executive Vice President and Chief Operating Officer.1

•Mr. Kelly, Executive Vice President, Chief Financial Officer and Treasurer.1

• Ms. Ratekin, Executive Vice President, General Counsel and Corporate Secretary.

Huron’s named executive officers are responsible for our Company-wide business operations and setting overall strategy of the organization.

Practice Leadership

Each of Huron’s operating segments is led by Practice Leadership and teams of client-facing managing directors. The Practice Leaders and client-facing managing directors for each business area are responsible for the financial results of their respective business area, including revenue and EBITDA growth, while ensuring delivery of superior solutions. These leaders have the critical talent and skills that make us unique and enable us to grow our business and compete in the marketplace. It is imperative to our core business strategy that we motivate and retain our current client-facing managing directors and obtain new talent through recruiting and developing our high potential employees so that they can progress to higher level leadership roles within the Company.

| Business Strategy | Our business strategy is to be the premier transformation partner to our clients. Through our integrated capabilities, we help organizations own their future in the face of rapid change. To ensure the success of our strategy and our ability to deliver sustained value to our shareholders, Huron focuses on the following drivers:

• Specialize in enabling organizations to lead through transformational change by providing integrated offerings built on the strength of our industry knowledge.

• Deliver high-value, quality services to our clients to support their comprehensive needs, from strategy setting to execution.

• Broaden and strengthen our capabilities to continue to best serve our clients while maintaining and growing our strong industry expertise.

• Attract, retain, and motivate top tier employees with diverse perspectives and experience levels, including subject matter and/or technical expertise.

• Supplement organic growth by successfully identifying, executing and integrating acquisitions that expand our current market offerings and deepen our industry expertise or broaden our capabilities to best serve our clients’ needs.

• Optimize our corporate infrastructure to effectively scale and support the Company’s long-term growth plans, while enhancing EBITDA margins.

|

1 | On January 3, 2017, Mr. John Kelly was promoted to the position of Executive Vice President and Chief Financial Officer (“CFO”). Formerly, Mr. Kelly had been Corporate Vice President and Chief Accounting Officer. With Mr. Kelly assuming the CFO role, Mr. Hussey has transitioned this role and has become Executive Vice President and Chief Operating Officer. Mr. Hussey also assumed the interim role of Healthcare Practice Leader. |

| | | Compensation Strategy | Our compensation philosophy has three key elements:

• Motivate and reward performance in the long-term best interests of shareholders.

• Deliver competitive total compensation generally targeted at the median of the peer group(+/-15%).

• Place a substantial portion of the compensation of our named executive officers at risk; actual payouts should vary based on the Company’s financial and operational performance. The performance measures directly link into our business strategy through net revenues, Adjusted EBITDA margin, and Adjusted Diluted EPS growth as well as fulfillment of strategic measures identified each year by the board of directors.

We annually grant a sizable portion of equity to our managing directors. An average of 80% of total equity granted in the last three years was awarded to our managing directors with the balance awarded to NEOs, other employees and directors. As a professional services firm, we recognize that our managing directors are critical to developing and maintaining client relationships, generating revenue and driving the overall success of Huron. We use stock as both a retention tool and an incentive to encourage behaviors that will benefit the shareholders and the Company. Approximately 50% of the annual bonus compensation of our Practice Leaders and client-facing managing directors consists of restricted stock that vests over four years, and is awarded based on prior year performance. We believe this element of our compensation aligns the interests of each of our practices with the Company as a whole and importantly differentiates Huron’s compensation program from our competitors’ programs, by aligning our managing directors with Huron’s long-term value creation.

|

| Business Results

| The Company’s financial and strategic performance during 2017 determineDuring 2023, Huron's named executive officer team consisted of the following individuals:

•C. Mark Hussey, President and Chief Executive Officer •J. Ronald Dail, Executive Vice President and Chief Operating Officer •John D. Kelly, Executive Vice President, Chief Financial Officer and Treasurer •Ernest W. Torain, Jr., Executive Vice President, General Counsel and Corporate Secretary1 (1)On March 11, 2024, Huron announced that Mr. Torain was leaving the Company effective March 15, 2024 and Hope Katz, Corporate Vice President, Legal Affairs and Corporate Secretary would assume the majority of our NEO’s compensation.Business results were as follows2:

• Our 2017 financial results came in lower than we expected, driven by further softness in our Healthcare business. The decline in Healthcare was partially offset by growth in our Education and Business Advisory segments.

• Net revenues were $732.6 million in 2017, compared to $726.3 million in the prior year.

• Adjusted EBITDA decreased 19.3% to $104.6 million in 2017, or 14.3% of net revenues, compared to 17.9% in the prior year.

• Adjusted diluted EPS was $2.15 in 2017, a 33.0% decrease from the prior year. While we delivered results that were lower than our initial guidance, we have made significant progress in the operational turnaround of our Healthcare business positioning us to be more responsive to changing market conditions. Among other initiatives, we have enhanced the level of collaboration across all of our service lines. Our efforts have better equipped the Healthcare business to compete across a wider spectrum of engagement sizes and durations by developing more flexible delivery models.

• We also completed two significant acquisitions in 2017. We acquired Innosight and Pope Woodhead in the first quarter, strategically adding to our Business Advisory segment. We believe these acquisitions strengthen our strategy capabilities and provide us with a comprehensive set of offerings to serve our clients—from strategy setting to execution. These acquisitions also strengthen our international footprint to best serve our growing, global client base. These acquisitions contributed almost $44 million in revenues during 2017 and performed largely as planned.

• In 2017, we defined our new, five-year enterprise-level strategy, created a unified sense of purpose and secured the commitment of our employees through a new vision, mission, set of values and modified brand positioning all designed to align with our strategy.

• We continued to align our corporate infrastructure with the evolving needs of our business to gain efficiencies and leverage our SG&A expense.

|

2 | In the discussion of the Company’s 2017 performance, the Compensation Committee discusses certain of Huron’s results of operations usingnon-GAAP financial measures, which are discussed in the Company’s Annual Report on Form10-K for the year ended December 31, 2017 (the “2017 Annual Report on Form10-K”), Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations under the subheading“Non-GAAP Measures.” Thesenon-GAAP financial measures include Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, and Adjusted diluted EPS. EBITDA is defined as net income (loss) from continuing operations before interest, income tax expense and depreciation and amortization. Adjusted EBITDA represents EBITDA as adjusted by adding back restructuring charges, goodwill impairment charges, other gains and losses,non-operating income and expense, and foreign currency transaction gains and losses. Adjusted EBITDA margin is Adjusted EBITDA expressed as a percentage of net revenues. Adjusted diluted EPS is defined as diluted earnings (loss) per share from continuing operations adjusted by adding back the same items as Adjusted EBITDA, in addition to amortization of intangible assets,non-cash interest on convertible notes, all on a tax effected basis, as well as tax expense related to the enactment of Tax Cuts and Jobs Act of 2017 and tax benefit related to“check-the-box” election.

|

| Impact of Results on NEO Compensation

|

Our NEO compensation relies heavily on performance-based pay – the annual and long-term incentive programs. The Compensation Committee establishes challenging goals that reflect the Company’s goals and business environment. The pay our NEOs ultimately earn is based on the level of achievement of these performance goals and our stock price performance.

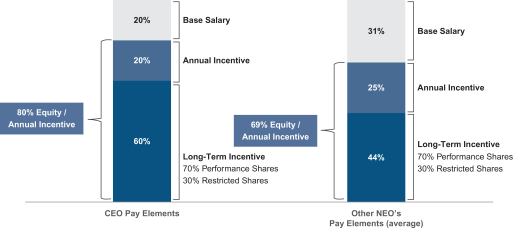

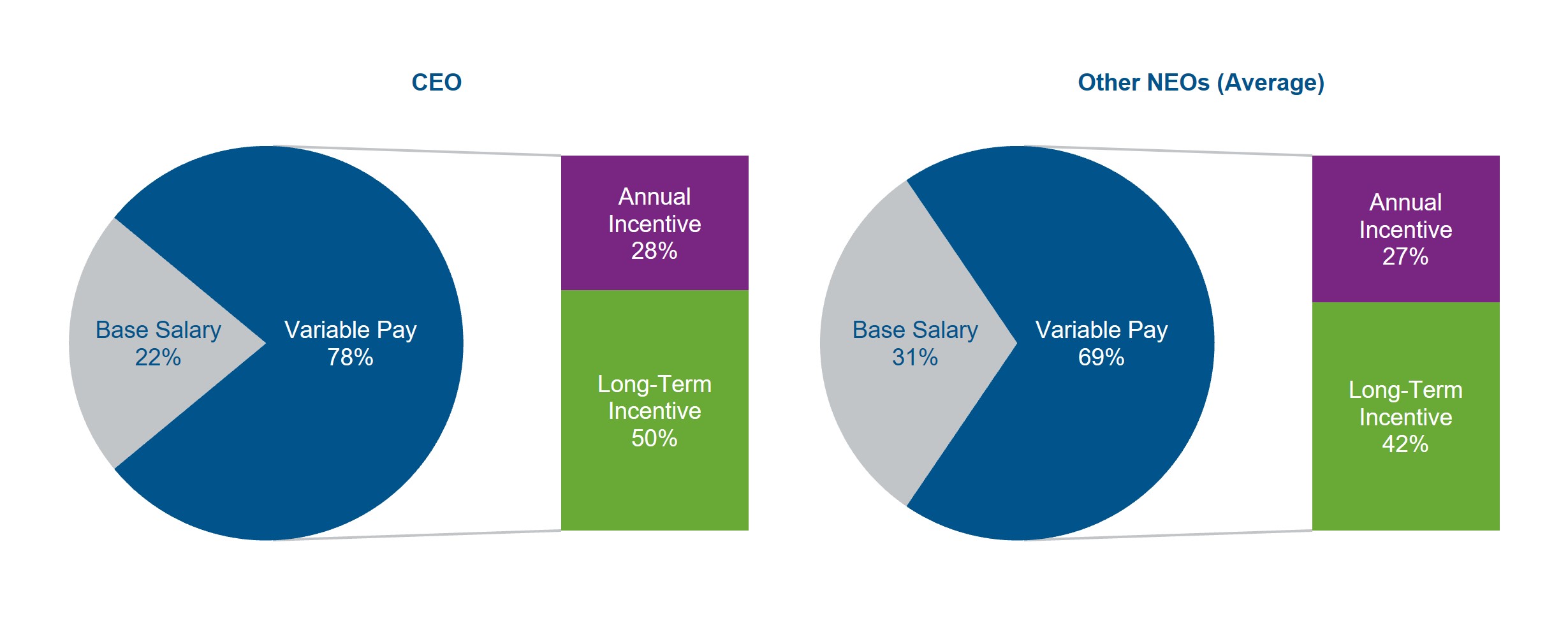

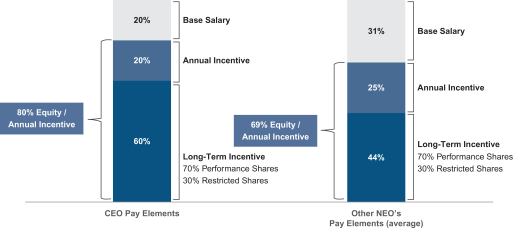

Target total compensation for our CEO in 2017 was 80% “at risk”, meaning that it is contingent upon and based on Company performance and stock price performance, and the target total compensation for our other NEOs was on average 69% “at risk”.

NEO Pay Mix (Target)

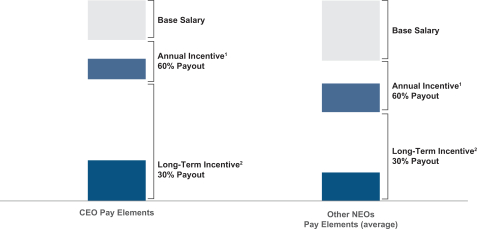

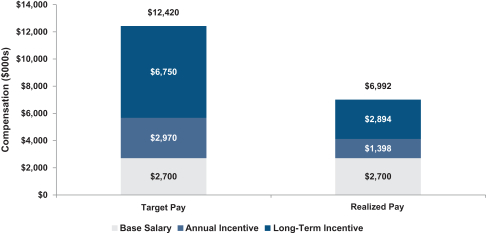

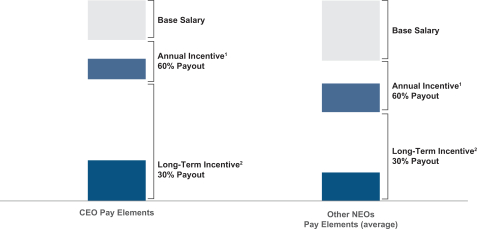

Our performance in 2017 against the predetermined goals did not meet our expectations, which resulted in a small portion of our NEO’s target compensation that was “at risk” being earned. The pay actually earned by our CEO and other NEOs, compared to the target, is shown below.

NEO Pay Mix (Actual)

(1) | The 2017 annual incentive award paid out at 60.2% of target.

|

(2) | The value of the 2017 long-term incentive reflects both a lack of payout on the Adjusted EPS component and the decline in our share price, with earned shares valued at the 12/31/17 price of $40.45.

|

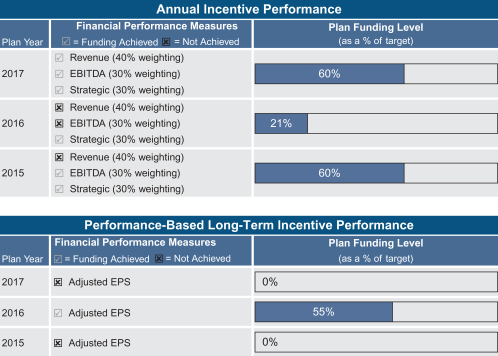

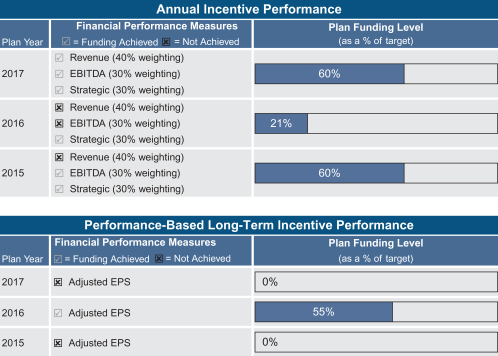

Our pay programs create alignment between Company performance and NEO pay, as illustrated for the prior three years in the tables below. Our annual incentives yielded payouts below target in each of those years, and our long-term incentive program has only provided a payout in one year, but at a below target level.

Our executive compensation programs are very aligned with shareholder value. This is reflected in a comparison of Mr. Roth’s target and realizable compensation. The graphTorain's responsibilities. Additional information is provided above under the caption "Executive Officers - Executive Leadership Transitions."

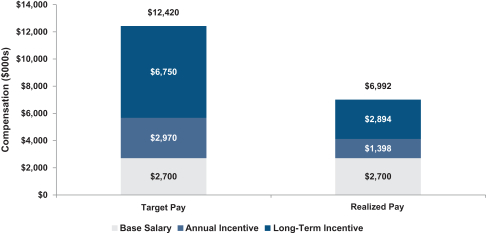

2023 HIGHLIGHTS As further described below, illustrates the target compensation opportunity provided to Mr. Roth for 2015-2017 compared to the actual value realized, when taking into account performance achievements under our incentive programs as well as share price changes. Mr. Roth realized 56% of his target pay opportunity over the 2015-2017 period.3-Year Aggregate CEO Pay ($000s)

(2015-2017)

(1) | Target Pay reflects the sum of the target compensation levels in each of 2015, 2016 and 2017.

|

(2) | Realized Pay reflects the sum of actual base salary paid, actual annual incentive earned and long-term incentive award value for awards granted in 2015, 2016 and 2017. The value of the long-term incentive reflects actual performance for completed performance periods and target performance for outstanding performance cycles, with all awards valued at the $40.45year-end share price.

|

| SECTION 2 - COMPENSATION PROGRAM OVERVIEW |

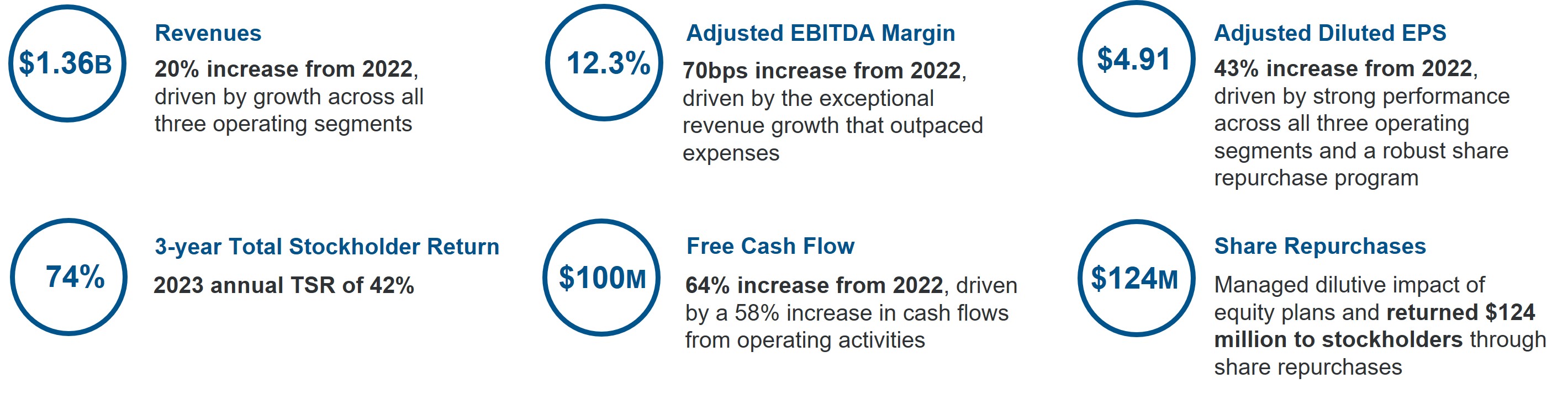

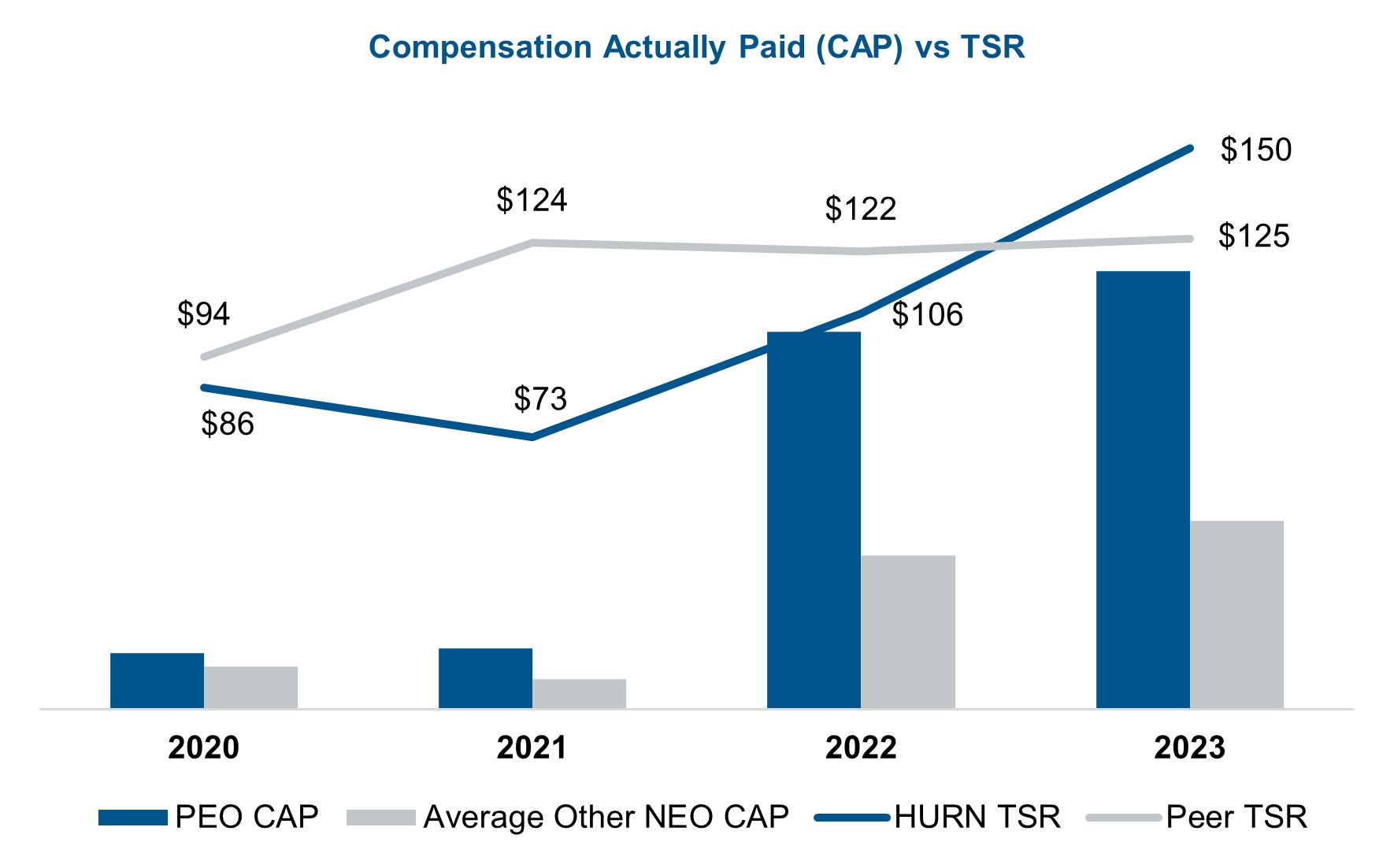

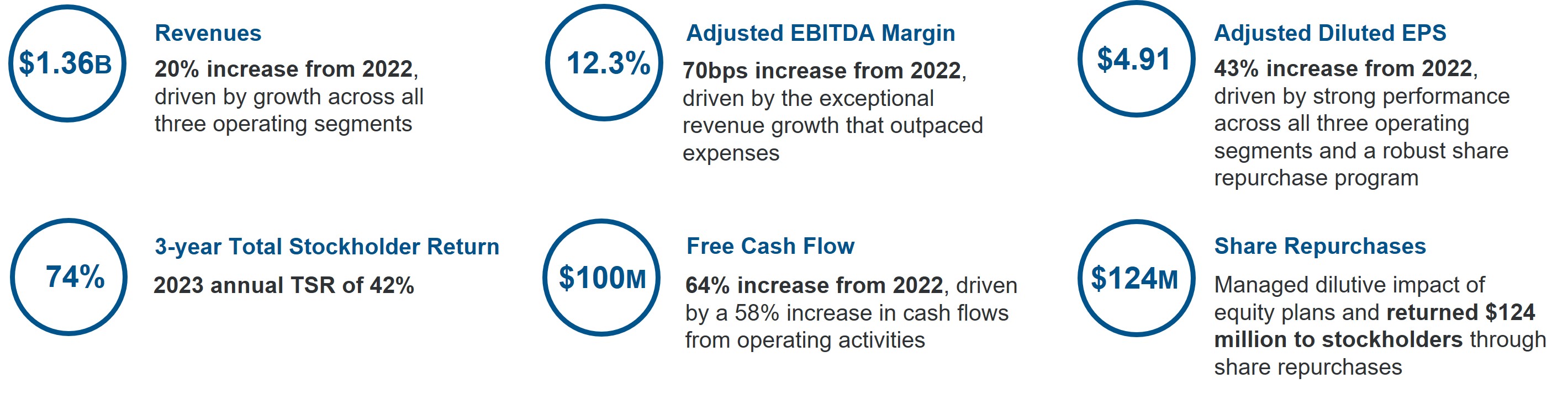

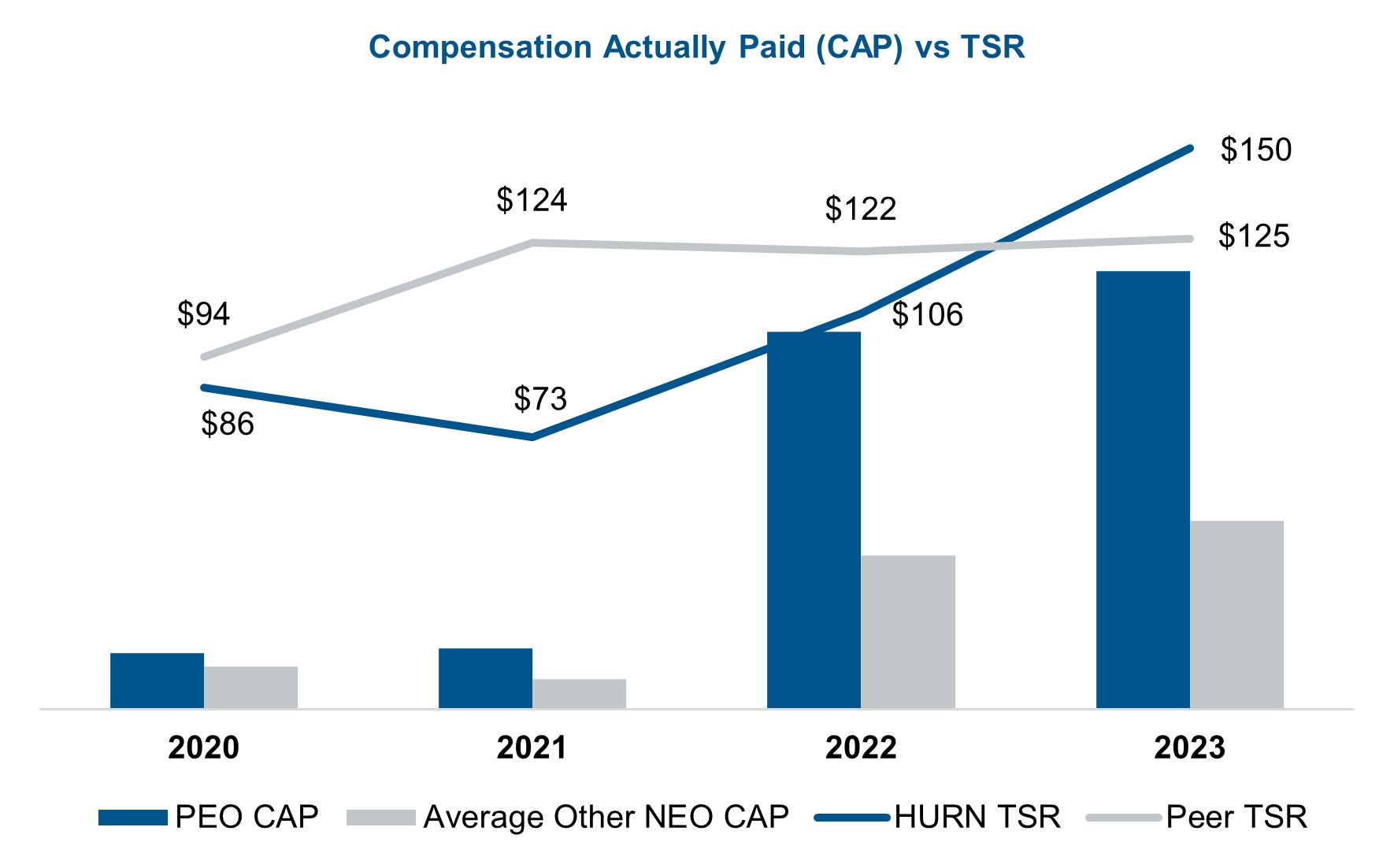

Huron’s executive compensation program is structured to align executive pay with Company performance. The strength of this alignment was recognized by our shareholders in 2017 as Huron received over 99% support on our shareholder advisory vote on executive compensation (commonly referred to as “Say on Pay”). We strive to provide compensation to motivateincentivize and reward performance that is indrives Company-wide success, achieves growth while effectively managing risk and aligns with the long-term best interests of our shareholders. stockholders. The record Company performance in 2023 is highlighted by the following achievements3.  3 In the discussion of the Company’s 2023 performance, the Compensation Committee discusses certain of Huron’s results of operations using non-GAAP financial measures, which are discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report on Form 10-K”), Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations under the subheading “Non-GAAP Measures.” These non-GAAP financial measures include adjusted EBITDA, adjusted EBITDA margin, adjusted net income, and adjusted diluted earnings per share. EBITDA is defined as net income before interest, income tax expense and depreciation and amortization. Adjusted EBITDA represents EBITDA as adjusted by adding back restructuring charges, other gains and losses, transaction-related expenses, unrealized gains and losses on preferred stock investments, and foreign currency transaction gains and losses. Adjusted EBITDA margin is adjusted EBITDA expressed as a percentage of revenues before reimbursable expenses. Adjusted diluted EPS is defined as diluted earnings (loss) per share adjusted by adding back the same items as adjusted EBITDA, excluding foreign currency transaction gains and losses and including amortization of intangible assets, all on a tax effected basis. Free cash flow for the years ended December 31, 2023 and 2022 is defined as operating cash flows of $135.3 million and $85.4 million, respectively, less capital expenditures of $35.2 million and $24.3 million, respectively.

In addition to record revenues and improved profitability, we further invested in our people, our clients and our communities highlighted by the following achievements. For additional information on our commitment to our employees and shaping a more sustainable future, refer to our 2023 Corporate Social Responsibility Report which is available on our investor relations website located at https://ir.huronconsultinggroup.com. Please note that information contained on our website is not incorporated by reference in this Proxy Statement or considered to be part of this document. EXECUTIVE SUMMARY Huron is a global professional services firm that collaborates with clients to put possible into practice by creating sound strategies, optimizing operations, accelerating digital transformation, and empowering businesses and their people to own their future. By embracing diverse perspectives, encouraging new ideas and challenging the status quo, we create sustainable results for the organizations we serve. Our business strategy is to be the premier transformation partner to our clients and our 5,500 global revenue-generating professionals are the cornerstone of our success. These employees use their deep industry, functional and technical expertise to help our clients adapt to rapidly changing environments and accelerate their business transformation to drive lasting, sustainable and measurable results. Our professionals' talents and skills, along with our unique company culture are strategic differentiators and enable the future success of our clients and Huron. To achieve our strategy, we are committed to: •Accelerating Growth in Healthcare and Education: Huron has leading market positions in healthcare and education, providing comprehensive offerings to the largest health systems, academic medical centers, colleges and universities, and research institutes in the United States. •Growing Presence in Commercial Industries: Huron’s commercial industry focus has increased the diversification of the Company’s portfolio and end markets while expanding the range of capabilities it can deliver to clients, providing new avenues for growth and an important balance to its healthcare and education focus. •Rapidly Growing Global Digital Capability: Huron’s ability to provide a broad portfolio of digital offerings that support the strategic and operational needs of its clients is at the foundation of the Company’s strategy. Huron will continue to advance its integrated digital platform to support its strong growth trajectory. •Solid Foundation for Margin Expansion: The Company is well-positioned to achieve consistent margin expansion, as well as strong annual adjusted diluted earnings per share growth. We are committed to operating income margin expansion by growing the areas of the business that provide the most attractive returns, improving the operational efficiency of our delivery for clients, and scaling our selling, general, and administrative expenses as we grow. •Strong Balance Sheet and Cash Flows: Strong free cash flows have and will continue to be a hallmark of Huron’s financial strength and business model. The Company is committed to deploying capital in a strategic and balanced way, including returning capital to shareholders and executing strategic, tuck-in acquisitions. We operate in a highly competitive talent market and our compensation philosophy is focused on motivating and effectively rewarding our professionals for their significant contributions. To continue to attract and retain highly qualified employees and align those employees' interests with the Company and stockholders, approximately 90% of the equity that we award each year is granted to non-NEOs, primarily our principals, managing directors and industry and capability leaders who are not covered by this Compensation Discussion and Analysis. Furthermore, to incentivize and retain employees below the principal and managing director level, we encourage participation in the Company's Stock Ownership Participation Program ("SOPP" or "Plan"). See Proposal 3 for additional information on our equity incentive strategy for our non-NEO employees and the proposed amendment to increase the shares available for grant under our SOPP and to extend the term of the Plan.

The criticality of our employees extends to our executive officers. Huron's growth, distinctive integrated operating model, and continued development of leadership in global regions strategically position the Company to identify, attract, hire and retain the caliber of leaders needed to meet our objectives. Accordingly, it is imperative that Huron's executives embody Huron's values and leadership principles, and have the expertise and experience that is essential to effectively leading and engaging a growing organization spread across multiple countries with varying business, economic and regulatory environments.

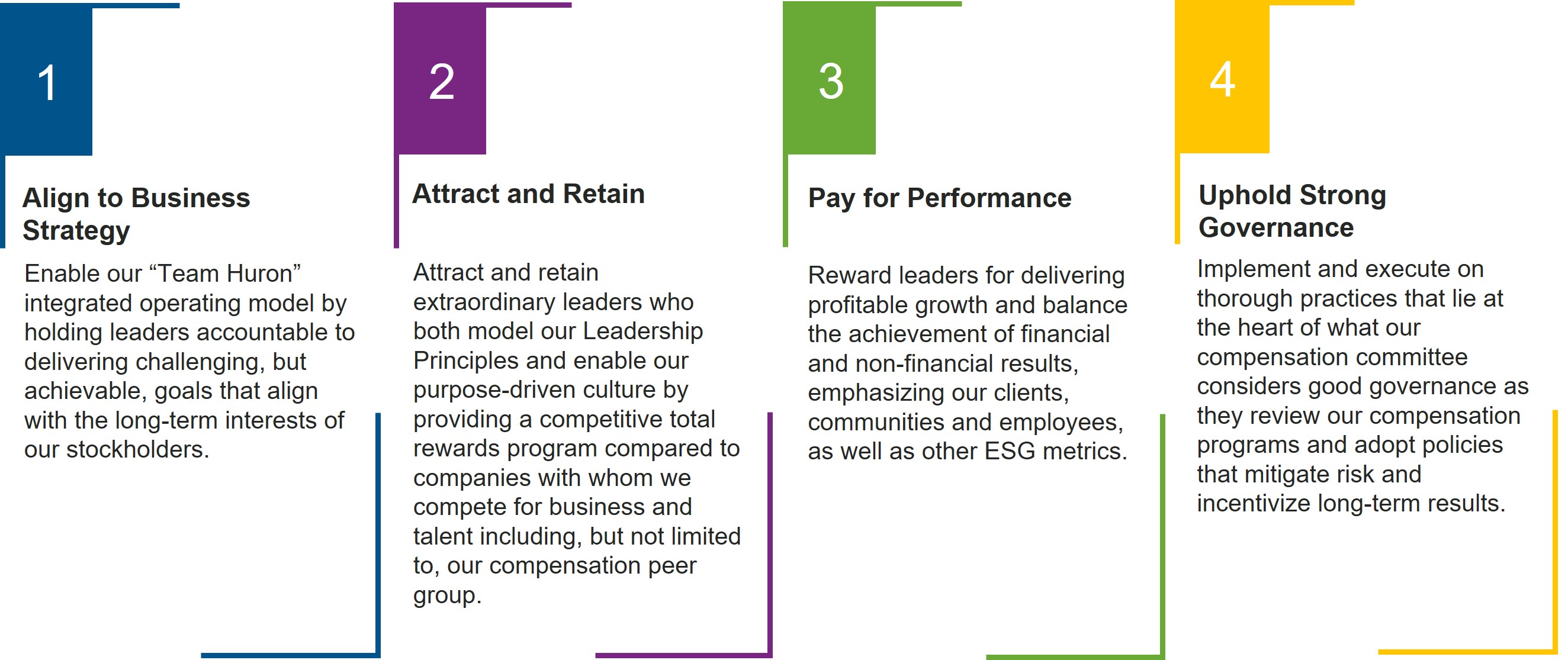

Huron’s Compensation Committee aligns our executives’ interests with the Company and stockholders through a careful and robust pay for performance compensation program, all while mitigating excessive risk-taking through vigorous oversight and governance practices. When determining 2023 executive compensation payouts and setting 2024 executive target compensation levels, the Compensation Committee was guided by the following principles and objectives. EXECUTIVE COMPENSATION PHILOSOPHY Huron considers a number of elements when making pay decisions and these core tenets drive our executive compensation philosophy:  We define performance under the executive compensation program as a blend of:Achievingof delivering value to stockholders, achieving financial performance in comparison topre-established financial goals,

Attaining and establishing and executing strategic initiatives that we believe are responsive to evolving market and economic conditions and critical to future stockholder value creation

Delivering value to shareholders

As partcreation. The Compensation Committee regularly reviews the design and administration of the program, we also evaluate several groups of peers depending on what we are measuring:

ForHuron’s executive compensation we use a peer group of publicly traded companies (“Executive Pay Peer Group”) where the size of the companies and the roles of the executive officers are similarprogram to those of Huron. We generally seek to target executive pay at the market median and in alignment withensure the pay data from this peer group. This pay data may at times be supplemented with broader survey data for specific executives, as appropriate.

For compensation of our client-facing managing directors (“Managing Director Peer Group”), we gather data from public and private companies and focus our comparators on the type of work performed, rather than primarily on the size or public/private nature of the organizations.

In order to assess our business performance, we review our business competitors, many of which are private, much larger in size or are subsets of larger companies. Therefore, obtaining comparative business results can be challenging. As a result, we have chosen to set executive performance goals based on absolute rather than relative performance measures.

In addition to these objectives, weprograms adhere to a comprehensive set of generally accepted best practices in the structuring and design of the compensation program.

this philosophy.COMPENSATION BEST PRACTICES | | | | | | | | | | | | | What We Do | | What We Do Not Do | Best Practice Elements:ü | Align pay with performance with a significant majority of compensation at-risk and based on objective financial performance measures | û | No excise tax gross-ups | •

ü | Appropriately balance short-term and long-term incentives | Establish Competitive Compensation Levels.We target the total direct compensation for our NEOs at levels that are generally within +/- 15%û

| No hedging or pledging of market median total direct compensation levels and tie actual compensation to performance.Huron stock | •

ü | Align executive compensation with stockholder returns through performance-based equity grants that include minimum time- vesting requirements | û | No stock grants are "timed" or awards to be repriced | | ü | Establish rigorous, achievable, and predominantly quantitative goals, that ensure focus, measurable progress and overall organizational advancement | û | No material executive perquisites not commonly available to the broader Huron employee population or to similarly situated key management employees |

| | | | | | | | | | | | | ü | Require the annual incentive program funding to be capped at target payout if total shareholder return for the year is negative | û | No "evergreen" features or liberal share counting provisions within our equity plan | | ü | Perform an annual risk assessment of our compensation programs | û | No automatic grants to any participant within the equity plan | | ü | Maintain a “Double Trigger.”In the event ofrobust stock ownership guidelines | | | | ü | Provide only double-trigger benefits in a change of control severance benefits are paid, andevent | | | | ü | Maintain a clawback policy providing for recoupment of incentive-based compensation | | | | ü | Retain an independent compensation consultant to the board | | | | ü | Administer the equity awards vest, only ifplans through the Compensation Committee, which is comprised entirely of independent directors | | | | ü | Mitigate potential dilution of equity award grants through our NEOs incur a qualifying termination.share repurchase program | | | •

ü | | Minimize Compensation Risks.We periodically reviewSolicit investor feedback on our compensation program to confirm that our compensation policies and practices are not encouraging excessive or inappropriate risk taking by our NEOs.

potential enhancements through an extensive stockholder engagement program | | |

EXECUTIVE COMPENSATION PAY COMPONENTS Our incentive plan design strives to execute on our market-competitive compensation philosophy through a meaningful mix of three principal components: (i) base salary, (ii) annual incentives and (iii) long-term incentives.

| | | | | | | | | | | | | Compensation Element | Form | Compensation Philosophy Alignment | What it Rewards | •

Base Salary | 100% Cash | Impose Robust Stock Ownership Guidelines.Our stock ownership guidelines require our NEOsProvide market competitive base pay that reflects role and responsibilities, ability to retain a significant equity stake ineffect Company results, executive's experience and individual performance.

| Accomplishment of day-to-day responsibilities, individual performance and the Company. NEOs are expected to retain a number of shares equal to at least 60%executive's experience and the competitiveness of the net after tax value from the exercise of stock options or vesting of restricted shares and performance shares until these guidelines are met.talent market. | •

Annual Incentive | 100% Cash | Maintain a “Clawback” Policy. We maintain aSet challenging, but attainable, goals that motivate exceptional performance against the annual operating plan and serves as key compensation recoupment policy (commonly referred to as a “clawback policy”), which generally providesvehicle for differentiating performance each year.

| Achievement of predefined financial, operational and strategic measures that are commensurate with performance against the Company may recover performance-based compensation paid to NEOs and such other individuals designated by our independent directors, if payout was based on financial results that were subsequently restated.annual operating plan. | •

Long-Term Incentive | 70% PSUs | Retain an Independent Compensation Consultant. The Compensation Committee retains an independent consultantFocus executives on the achievement of strong performance against long-term strategic and financial goals to assist in developing and reviewing our NEO compensation strategy and to confirm thatdirectly align executive's interests with the design and pay levelslong-term interests of our compensation programs are appropriately consistentstockholders.

| Alignment of stockholder interests with ourthe attainment of long-term financial goals and market practices.share price appreciation. | •

30% RSUs | | Consider the Impact of Tax and Accounting Rules. The Compensation Committee takes into account the effect of tax and accounting rules in structuring our NEO compensation program. The Compensation Committee reserves the right to pay compensation that may not be deductible under Section 162(m).

| •

| | Review Share Utilization. We regularly review overhang levels (the dilutive impact of equity awards on our shareholders) and consider such levels in our consideration of future equity grants.

| •

| | No Excise TaxGross-Ups. Our NEOs are not entitled to receive any“gross-up” payments related to excise taxes that may be imposed in connection with golden parachute arrangements under the Company’s change of control severance plan.

| •

| | Hedging or Pledging of Company Stock. The board has adopted a revised Insider Trading Policy that prohibits directors, officers, employees, and contractors from hedging activities, holding Company securities in a margin account or pledging Company securities as collateralProvide for a loan.

| •

| | No “Timing” of Equity Grants. We maintain a disciplined equity approval policy. We do not grant equity awards in anticipation of the release of material,non-public information. Similarly, we do not time the release of material,non-public information based on equity grant dates.

| •

| | No Executive Perquisites that are not provided widely at Huron. We do not provide material benefits or perquisites to our NEOs that are not provided widely within Huron.

long-term executive retention. |

| SECTION 3 - COMPENSATION PROGRAM DETAILS |

Targeting

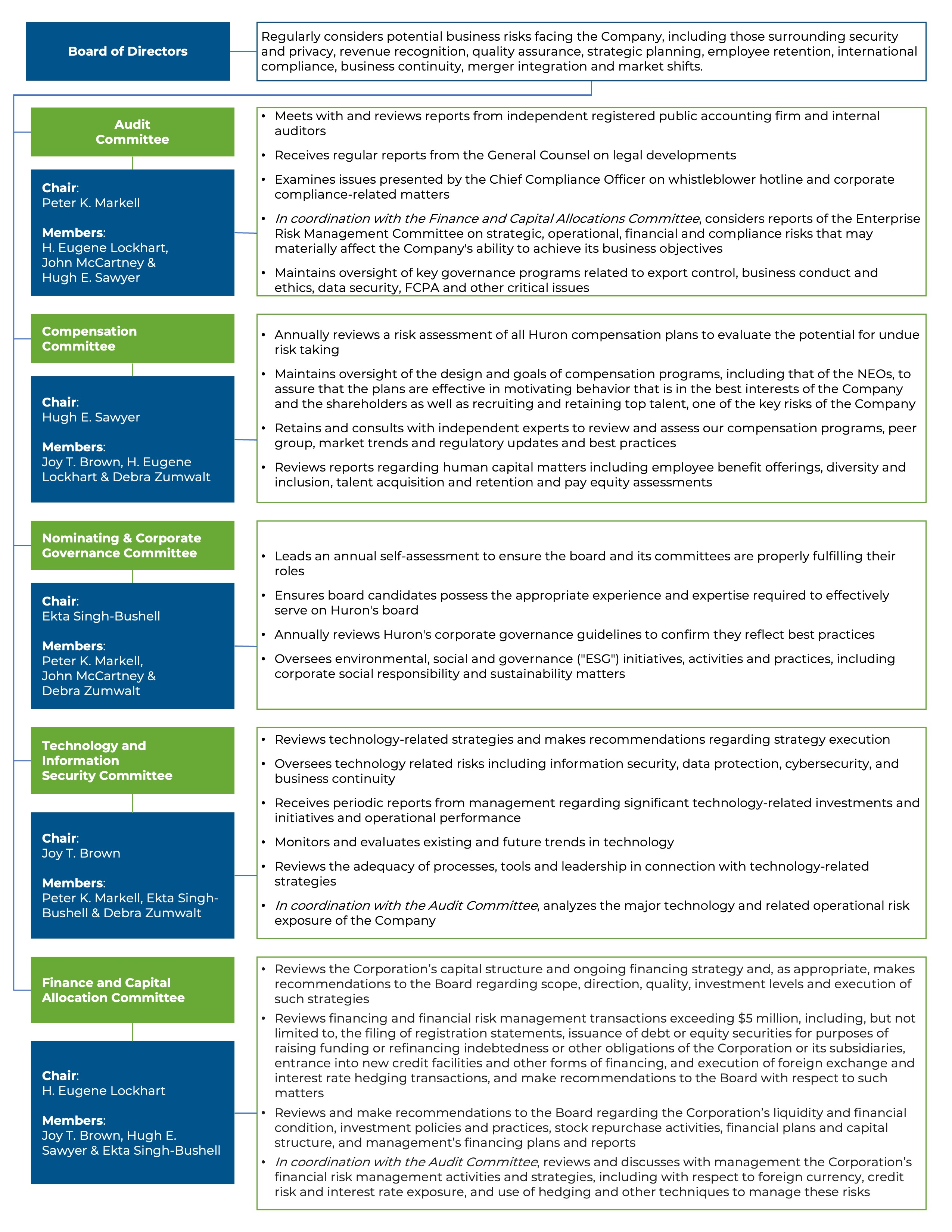

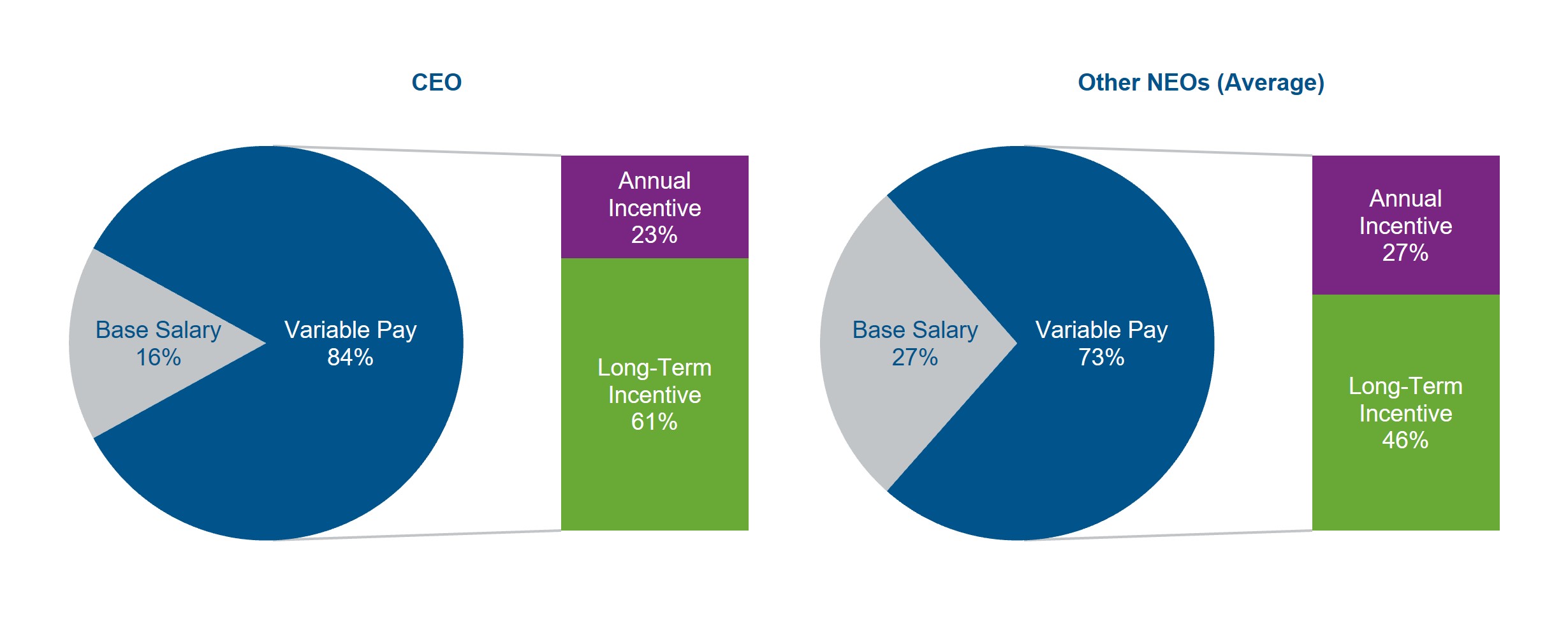

The 2023 program design continued to align our NEOs' interests with those of Total Direct Compensationthe stockholders by maintaining a majority of NEO compensation as performance-based and at-risk. The chart below illustrates the 2023 target mix of pay for the NEOs under the 2023 annual and long-term incentive programs.

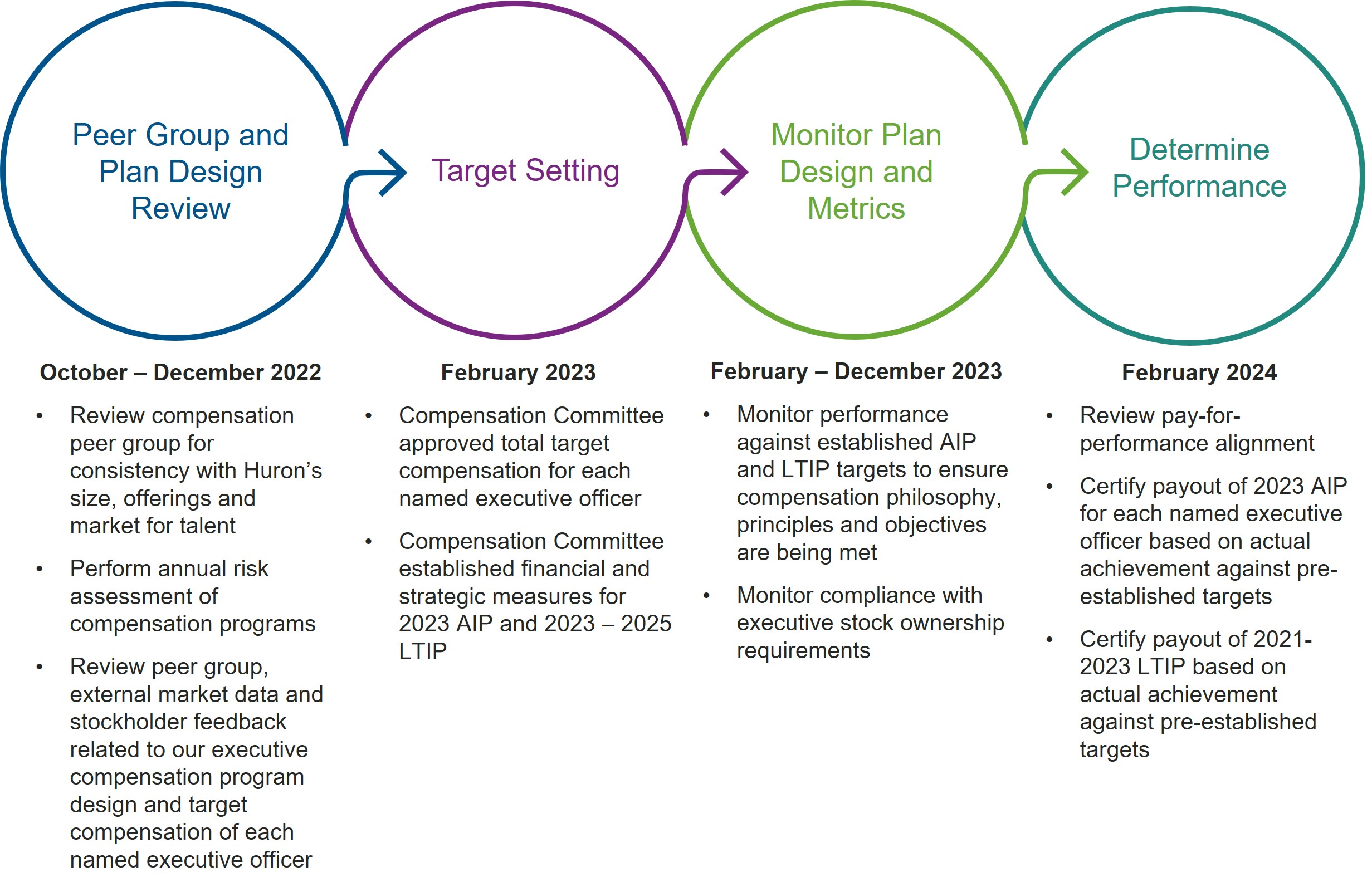

2023 NEO Pay Mix at Target GOVERNANCE OF EXECUTIVE COMPENSATION PROGRAM The Compensation Committee, generally targets total directwith support from management and independent compensation to be within+/-15%consultants, is primarily responsible for designing, reviewing, and evaluating our executive compensation program in a manner consistent with our compensation philosophy, principles and objectives, through the following annual compensation-setting process.

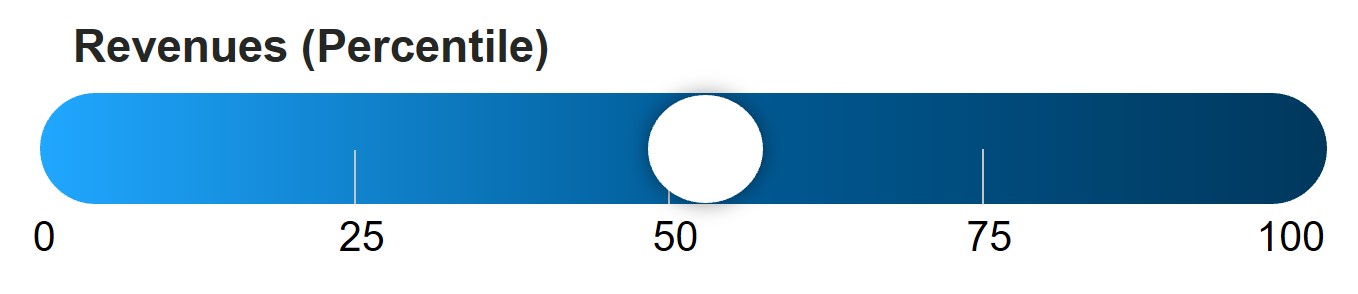

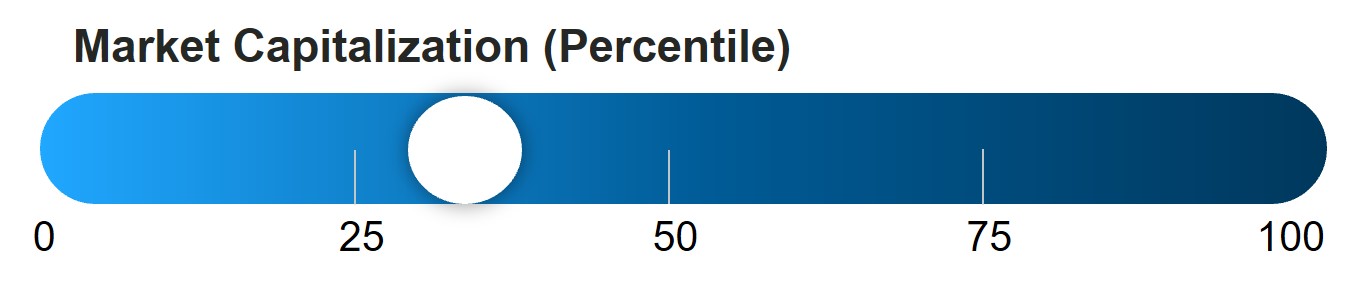

Role of the median of the Executive Pay Peer Group for our NEOs. Compensation Committee The Compensation Committee alsois primarily responsible for administering our executive compensation program in a manner consistent with our compensation philosophy and objectives. The principal functions of the Compensation Committee are to: •set salaries and annual and long-term incentive levels for the CEO and other named executive officers, so that the program is promoting stockholder value; •evaluate annually the performance of the CEO (in coordination with the full board) and review the CEO evaluation of the other named executive officers; •review and approve the design and competitiveness of our executive compensation plans, including benefits and perquisites; •review the design, competitiveness and pay equity of our Company-wide compensation plans, including benefits; •review and approve the total cash and stock bonus pools for the organization, and approve the individual incentive payout awards for the named executive officers; •review director compensation and make recommendations to the board; •review and approve goals used for the annual and long-term incentive plans; •retain or terminate, in its sole discretion, any independent compensation consultant used to assist the Compensation Committee; •review and evaluate compensation arrangements to assess whether they could encourage undue risk-taking; and •create a Compensation Committee report on executive compensation for inclusion in the Proxy Statement. The Compensation Committee exercises its judgment on an independent basis and works closely with our board of directors and the executive management team in making many of its decisions. To support its decision making, the Compensation Committee has retained the services of an independent compensation consultant. The Compensation Committee has the sole authority to amend or terminate the services of its independent consultant. The Compensation Committee is comprised entirely of independent directors. Role of Management Our CEO, along with the chief human resources officer and other members of senior leadership, support the Compensation Committee's design, review and evaluation of the executive compensation program. The executive officers provide recommendations for the financial and strategic measures within the annual incentive and long-term incentive programs, which are grounded in Huron's long-term growth strategy and market data. Additionally, our CEO provides a review of each named executive officer's annual performance but does not participate in the decisions related to his own compensation. The Compensation Committee carefully reviews and deliberates all recommendations provided by management. Additionally, to support the Compensation Committee's review and approval of the total cash and stock bonus pools available for the organization, and to ensure the Company-wide compensation programs appropriately balance stockholder returns and employee retention, the executive officers regularly review Company, Industry and Capability performance with the Compensation Committee. Role of Compensation Advisor The Compensation Committee retains an independent advisor to assist in the ongoing assessment of our executive compensation strategy and program. The Compensation Committee's independent advisor reports directly to the Compensation Committee and serves at its sole discretion and does not perform any services for the Company other than those in connection with its work for the Compensation Committee. Pay Governance serves as the Compensation Committee’s independent advisor. The Compensation Committee annually assesses whether the independent advisor's work has raised any conflict of interest. The Compensation Committee has determined, based on its analysis of NASDAQ requirements, that the work of Pay Governance and the individual compensation advisors employed by Pay Governance as compensation consultants to the Company has not created any conflict of interest. Role of the Peer Group The Compensation Committee reviews external market data fromto inform its decisions about executive compensation, specifically to determine a range of pay, inclusive of salary, target annual incentives, and target long-term incentive awards. Total direct

compensation, as well as the components thereof, are compared to similar roles and responsibilities for those of the Compensation Committee-approved peer group described below, as well as Radford GroupGlobal Technology Surveysurvey data for companies with annual revenue between $500Mcomparable total revenues as Huron. Individual target pay is benchmarked against these external market sources, but can and $999.9M. This data informs the Committee’s decisionsdoes vary based on pay adjustments.2017 Base Salary, Annualseveral factors including each individual executive officer's experience, qualifications and Long-Term Incentive Changes

During 2017,performance. We note that the Compensation Committee approved changesdoes not target NEOs’ pay to botha specified percentile relative to the 2017 Annual and Long-Term Incentive Plans. These changes were made with the goalbelow Compensation Peer Group, but rather reviews peer group compensation data for each element of continuing to evolve and improve the programs with the organizational needs of the Company, while ensuring a clear correlation between pay and performance, and effectively motivating the NEOs toout-perform expectations. The Compensation Committee approved 2017 compensation, levels (baseincluding base salary, cash annual incentive, long-term incentive targets, and target annual and long-term incentive) in February of 2017.

| | | | | | | | | | Compensation Element | | James H. Roth | | C. Mark Hussey | | John D. Kelly | | Diane E. Ratekin | Base Salary | | $900,000 | | $750,000 | | $325,000 | | $400,000 | Target AIP Payout | | 110% of base salary | | 100% of base salary | | 70% of base salary | | 50% of base salary | Target LTI Payout | | 300% of base salary | | 175% of base salary | | 100% of base salary | | 115% of base salary |

For 2017, the Compensation Committee increased Mr. Hussey’s base salary to $750,000 from $600,000 to recognize his performance, his leadership role in the creation of Huron’s long-term strategy, and his increased role leading the transformation of the Healthcare practice. They also increased Mr. Roth’s target LTI to 300% from 225% and Ms. Ratekin’s target LTI to 115% from 100% to be more market competitive, and increased Mr. Kelly’s total compensation by 105% to compensate for his promotion to Chief Financial Officer from Chief Accounting Officer.

For 2018, the Compensation Committee increased Mr. Kelly’s(target total compensation by 32% to be more market competitive. His salary was increased from $325,000 to $400,000 and his LTI was increased from a target of 100% to 120%.

2017 Annual Incentive

The Compensation Committee approved a performance-based Annual Incentive Plan for 2017. The maximum incentive opportunity for 2017 increased from 125% to 150% of target to better align with market practice and to enhance the incentives for participants to achieve maximum performance levels. Based on the actual results on each of the performance measures, a total annual cash incentive payout of 60% of target was earned.

This amount is reflected in the Summary Compensation Table asNon-Equity Incentive Plan Compensation.

This plan is structured as shown in the table below:

| | | | | | | | | | | | Performance Measure | | Weighting | | Threshold | | Target | | Maximum | | Actual | Net Revenue | | 40% | | $729M | | $759M | | $829M | | $733M | Adjusted EBITDA Margin | | 30% | | 14.3% | | 15.2% | | 16.0% | | 14.3% | Strategic Measures* | | 30% | | Committee Discretion | | 100% | | 150% | | 125% |

* The Committee reviewed and discussed the NEOs’ performance against the strategic measures that were established at the beginning of the year. The Committee identified overachievements against certain objectives and determined the overall level of performance resulted in a payout on the strategic measures of 125% of target.

Note: A performance threshold of $0.05 Adjusted Diluted EPS which must be exceeded prior to the payout of the 2017 Annual Incentive Plan is designed to comply with the terms of Section 162(m). If $0.05 Adjusted EPS is exceeded, the Compensation Committee can approve a payout of up to 150% of target. The $0.05 Adjusted Diluted EPS was exceeded in 2017.

2017 Long-Term Equity Grants

On March 15, 2017, Huron made long-term equity grants that were structured as 70% performance units and 30% restricted shares.

| | | | | | | | | Executive | | Performance Units

Granted* | | | Restricted Shares

Granted | | James H. Roth | | | 46,210 | | | | 19,804 | | C. Mark Hussey | | | 22,463 | | | | 9,627 | | John D. Kelly | | | 5,562 | | | | 2,384 | | Diane E. Ratekin | | | 7,873 | | | | 3,374 | |

* | Full performance unit grant at target performance.

|

In August of 2017, the Compensation Committee awarded Mr. Hussey an award of restricted shares with a grant date fair value of $1,000,000 in order to recognize his contributions as the interim leader of the Healthcare practice during its ongoing transformation as well as his critical role to the ongoing success of the business.

Restricted Stock Awards

The restricted stock granted to our NEOs vest 1/3 per year over three years, based on continued service to ensure retention. In addition, the Company must exceed $0.05 Adjusted EPS in the year of grant or the awards will be forfeited. This condition is designed to satisfy the provisions of Section 162(m). This condition was met in 2017.

Performance Share Awards

The performance share awards are tied to both three-year performance and annual performance. The performance share plan was redesigned for 2017, following the completion of the initial three-year performance cycle (2014-2016). The 2017 performance share plan maintains theone-year performance period (60% of award) and a three-year performance period (40% of award). Theone-year performance is measured 100% based on 2017 Adjusted Diluted EPS and any earned shares will vest ratably over three years. The new three-year performance period will be measured 100% based on 2019 Adjusted Diluted EPS, and any earned shares will immediately vest on March 15, 2020, after the end of the three-year performance period. Payout opportunity remains 50% of target for threshold performance and 200% of target for maximum performance. No shares are earned for performance below threshold.

2017 Annual Performance Measures and Results:

The Compensation Committee established Adjusted Diluted EPS as the performance measure for PSUs with payouts ranging from 0% to 200%. Actual performance came in below the threshold; therefore, performance share units were not earned as presented in the chart below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2017 Performance Targets (1) | | | | | | Actual Performance | | | Measure | | 0% | | | 25% | | | 100% | | | 150% | | | | | | 200% | | | Actual | | | PSU

Earned

Percent | | Adjusted Diluted EPS | | <$ | 2.31 | | | $ | 2.31 | | | $ | 2.46 | | | $ | 2.76 | | | | | | | $ | 3.16 | | | $ | 2.15 | | | | 0 | % |

(1) | Actual Adjusted Diluted EPS is calculated on a continuing operations basis and excludes certain acquisitions completed in 2017.

|

2018 NEO Compensation Program Design Changes

During 2017, we undertook a review of our NEO compensation program to ensure it continues to support our business and talent strategies, appropriately reflects peer practices, and aligns with shareholders in recognition of our ongoing transformation.

Based on this review, the Committee approved a number of changes to the NEO compensation program for 2018:

| | | 2018 Annual Incentive Program | Changes Made: | | Reasons for Change: | • Adding organic revenue growth as performance measure, replacing the budgeted revenue goal.

• Adding greater specificity to and limiting the number of strategic objectives.

• Widening the performance/payout range.

| | • Creates enhanced emphasis on the importance of top line growth in growing share price.

• Provides greater clarity to performance expectations and reduces subjectivity in assessing performance.

• Better reflects competitive practices while maintaining our performance focus by providing lower than typical payout for below target performance and by requiring greater performance for a maximum payout.

|

The 2018 annual incentive program design is summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Threshold | | | Target | | | Maximum | | | Performance Measure | | Weighting | | | Performance | | | Payout | | | Performance | | | Payout | | | Performance | | | Payout | | Organic Revenue Growth | | | 40 | % | | | 95 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 111 | % | | | 200 | % | Adjusted EBITDA Margin | | | 30 | % | | | 85 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 115 | % | | | 200 | % | Strategic Measures* | | | 30 | % | | | 85 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 115 | % | | | 200 | % |

* At the beginning of 2018, the Compensation Committee approved specific strategic measures focused on further development of each practice area and further improvements in the effectiveness and efficiencies of Huron’s infrastructure. A target award would reflect full achievement of these objectives, as assessed by the Committee. The Committee applies its judgment in determining overall performance on the measure.

| | | 2018 Long-Term Incentive Program | Changes Made: | | Reasons for Change: | • Utilizing a full three-year performance measurement cycle.

• Adding a revenue growth goal to complement the adjusted EPS goal.

| | • Reflects multi-year performance rather than the sum of annual goals.

• Focuses on the importance of top line growth to drive shareholder value.

|

The 2018plus long-term incentive program design is summarized below:

| | | | | | | | | | | Vehicles | | Weighting | | | Performance Measure | | | | Performance/Vesting Timeline | Performance Units

| | | 70 | % | | 40% Adjusted Diluted EPS

30% Organic Revenue Growth | | Three-Year (cliff) | Restricted Shares

| | | 30 | % | | Continued employment | | Three-Year (ratable) |

compensation). | SECTION 4 - ADDITIONAL DISCLOSURES RELATED TO COMPENSATION PROGRAM |

Executive Pay Peer Group

The peer group developedis comprised of U.S.-based companies who are business-to-business service providers in 2016 to inform 2017 pay decisions was modified based on the annual review of Executive Pay Peer Group criteria. The Compensation Committee elected to expand the peer group from 11 companies to 16 companies. The Committee believes that this larger peer group will provide better insights into the compensation practices of business peers and will be less volatile due to the compensation changes made by one company. Companies were identified based on the following process: | 1. | All companies were identified that met the following criteria:

|

US headquartered and publicly traded.

Revenue betweenone-half to two times Huron’s trailing 12 months’ revenue as of Huron’s 2016 fiscalyear-end.

Global Industry Classification Standard (GICS) codes: Research and Consulting Services, Human Resource &and Employment Services, Application Software,Health Care Technology, Health Care Services, or Technology, or Data ProcessingIT Consulting and Outsourced Services.

| 2. | Companies were then screenedOther Services industry sectors with revenues within 0.1x to 5.5x of Huron’s revenues and selected that best met the following set of factors:

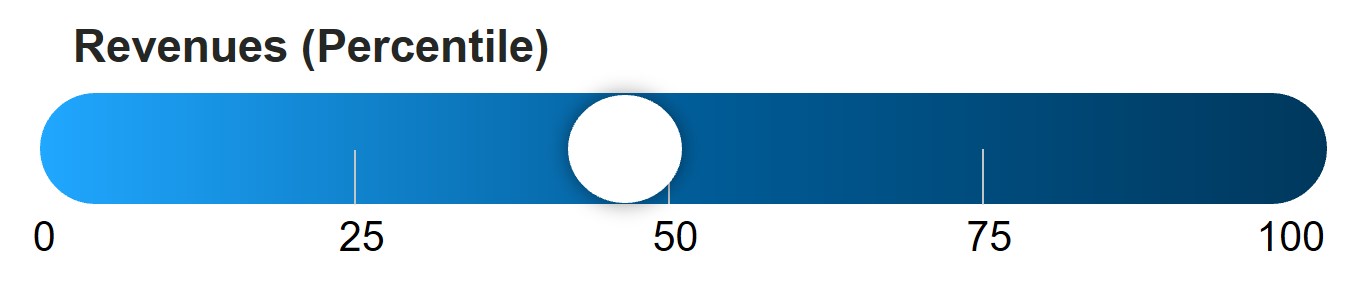

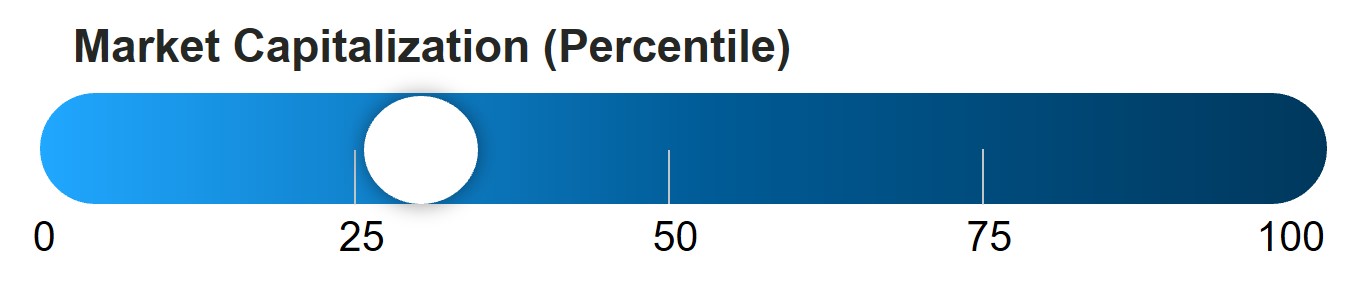

|